What if you used stock options to conserve cash for compensating employees, advisors, and your management team?

Structured employee incentive stock options plan templates make it easy.

Everyone loves owning a piece of the business!

Here’s exactly how to set it up and make it work — while you maintain control.

Establish clear ownership terms between yourself and your team.

Software app with templates documents ownership shares and manages founder’s stock and options allocations for your team, advisors, and contractors.

Stock Options Builder is a software system that manages a collection of sample employee stock options template documents, professionally formatted in Word, that you can easily edit or reformat to your liking.

Stock Options Builder also includes a handy spreadsheet template in Excel for managing and tracking

your executive and employee stock ownership and options — just fill in the variables and print.

Try FREE Here — No Credit Card Required

Click on the “Finance” tab (middle menu-bar), See “Stock Options” lower Left

Inspire exceptional engagement and performance…

With the opportunity to own shares in the company!

Nearly 134,000 people were polled recently — and 61% of them

said this motivates them to perform their jobs at a higher level:

Having a financial / ownership stake in the company!

“The defining difference between Silicon Valley companies and almost every other industry in the U.S. is the virtually universal practice among tech companies of distributing meaningful equity (usually in the form of stock options) to ordinary employees. Before companies like Fairchild and Hewlett-Packard began the practice fifty years ago, distributing stock options to anyone other than top management was virtually unheard of. But the engineering tradition that spawned Silicon Valley was much more egalitarian than traditional corporate culture.”

~ Steven Johnson, The Peer Society

When implemented properly, broad employee ownership within a company can:

- Align the risk and reward of employees betting on an unproven company.

- Reward long-term value creation and thinking by employees.

- Encourage employees to think about the company’s holistic success.

Use Stock Options for key person and advisor compensation.

Conserve cash for other purposes.

One of the easiest, best, and relatively economical incentives to motivate valuable executives and

employees is to give them ownership in your company through options to purchase shares of stock.

Stock options are great for rewarding employees, contractors and other contributors to your

business for their continued support, contributions and long-term commitment.

They’ll feel the ownership, and enjoy the reward of staying the course and

helping you to build your business.

How much stock should you give your people?

- How Much Equity Should You Give Your Employees?

- Read more about how to effectively allocate stock options in Andy Rachleff’s article:

The Right Way to Grant Equity to Your Employees - Harvard Business Review: the Founders Dilemma

Why stock options and not just shares?

If you gave your employees the actual shares now, they would be immediately

liable for income tax based upon the value of the shares today.

With stock options, you are promising them that they can buy shares in the future,

based upon your share price today… since you haven’t actually paid them anything,

therefore there would be no tax liability.

So, stock options are the way to go.

How “Vesting” works with Employee Stock Options

Your executives and employees can purchase only the stock option shares they earn:

Vesting gives executives and employees the right to purchase an increasing

percentage of their shares as time goes by…

For example, using a 5-year stock options vesting schedule, an employee would

be eligible to purchase only 20% of their stock options at the end of the first year.

This way, if an employee or executive quits (or you must fire them), they can purchase

only a prorated fraction of their original allotted number of stock options based upon

the amount of time they actually worked for you.

Forfeited shares go back into the option pool.

A quick overview of the templates included:

Complete sets of both Incentive / Qualified AND

Non-Qualified options plan documents included

(Instructions explain the differences and provide step x step direction.)

Cover Letter to Employees

Dear employee… Here is the paperwork that says, “You get a piece of the action…”

Read these documents, sign them, and file everything for the future.

You will share in the wealth as the value of the company increases.

It’s actually a formal letter explaining the contents of the packet that you are giving them.

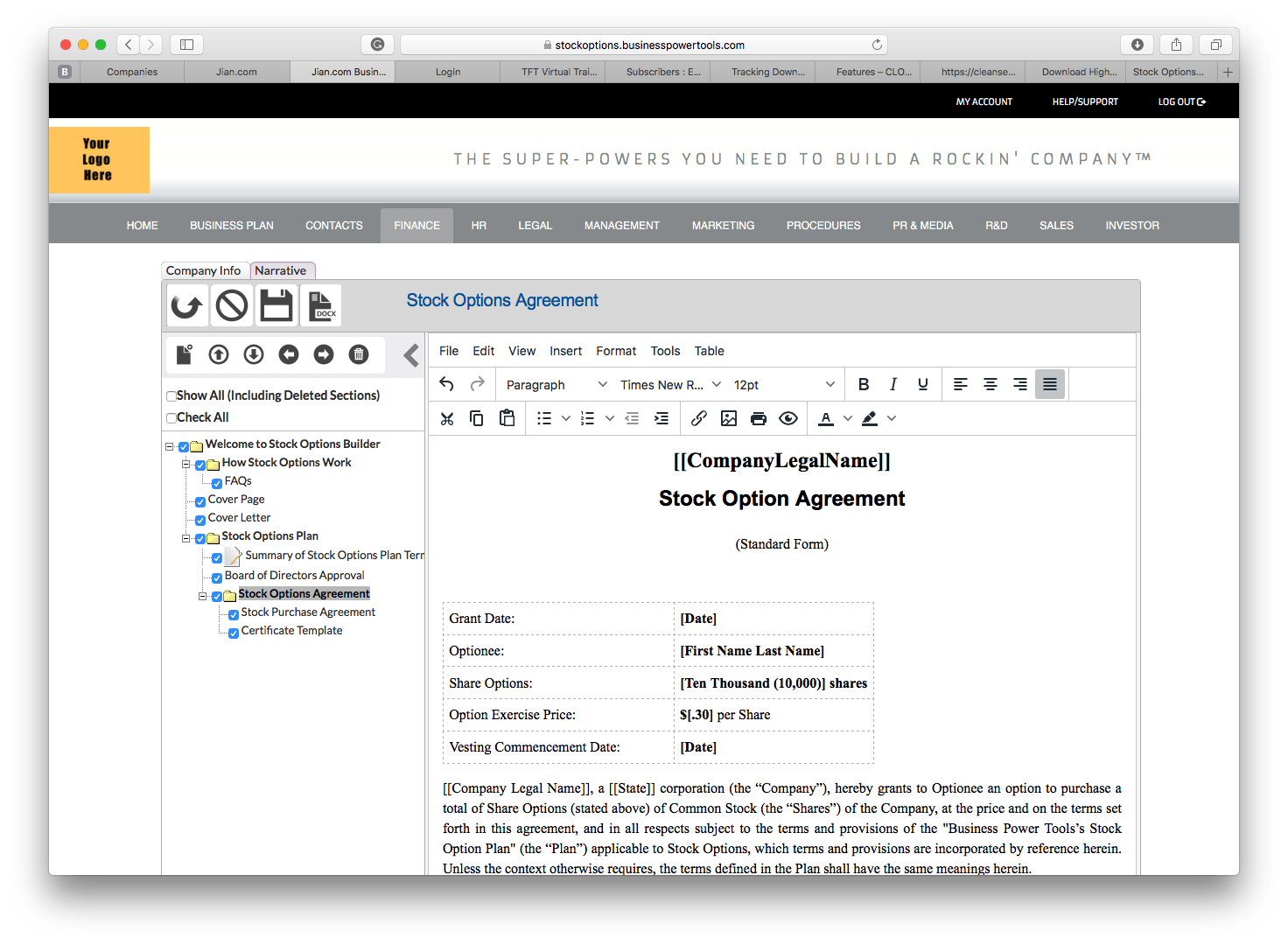

Stock Option Agreement

This makes the incentive real in the minds of your employees and partners.

All the benefits of owning shares (except voting rights) without the tax liability.

Pay for the shares and the taxes when the value has been built.

Usually when your company is acquired or goes public,

a simultaneous transaction is created whereby you and your

employees purchase the options and immediately receive the proceeds.

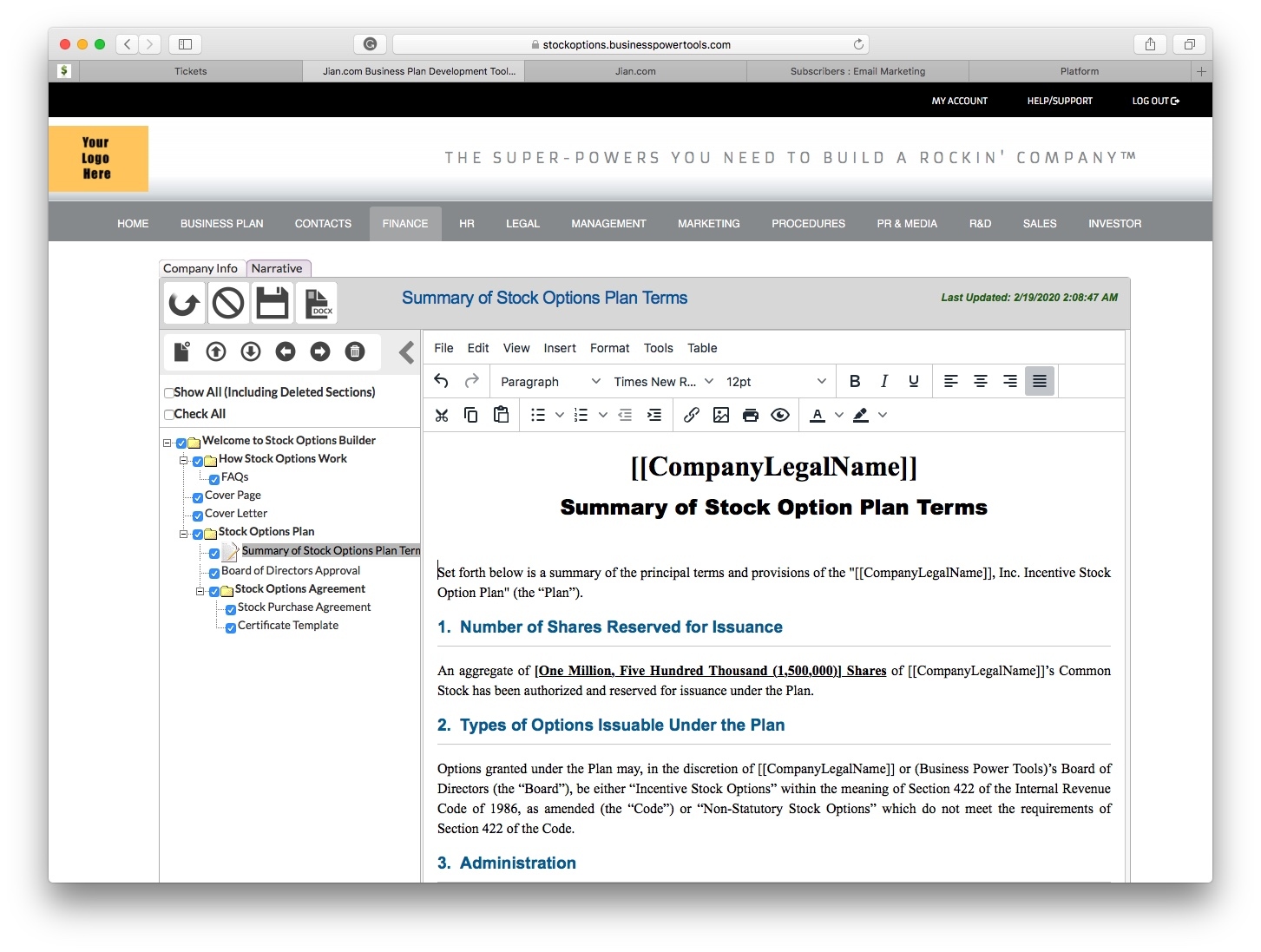

Stock Option Plan

Describes all of the legal details of a properly executed incentive stock option plan.

What you and they can and cannot do, vesting, what to expect, dates, contingencies, disclaimers, etc.

Summary of Terms of the Stock Option Plan

This handy information sheet further explains many of the

details involved in an Incentive Stock Option Plan.

Common Stock Purchase Agreement

When it’s time to actually purchase the stock,

you have the paperwork to complete the process.

Board of Directors’ Approval

The formalities are serious. This makes it official.

We make sure that you do it right.

Fill in who gets how much stock, have your Board of Directors sign it,

and you have officially approved granting stock options to your people.

Use this handy form over and over again whenever you want to issue more options.

Stock Certificate

While we recommended purchasing some nice certificate paper

at your local stationery store, we provide the template for printing

your actual certificate on the front, as well as the restrictive legend on the reverse.

All of this saves significant legal time!

Executive Employment Agreement

While you’re likely to employ everyone at your company on an “at will” basis,

this agreement template enables you to establish compensation and

stock allocation as part of each team members compensation.

It’s a very handy document to have and use!

Number of shares, allocation, vesting, % ownership…

Done for You!

![]()

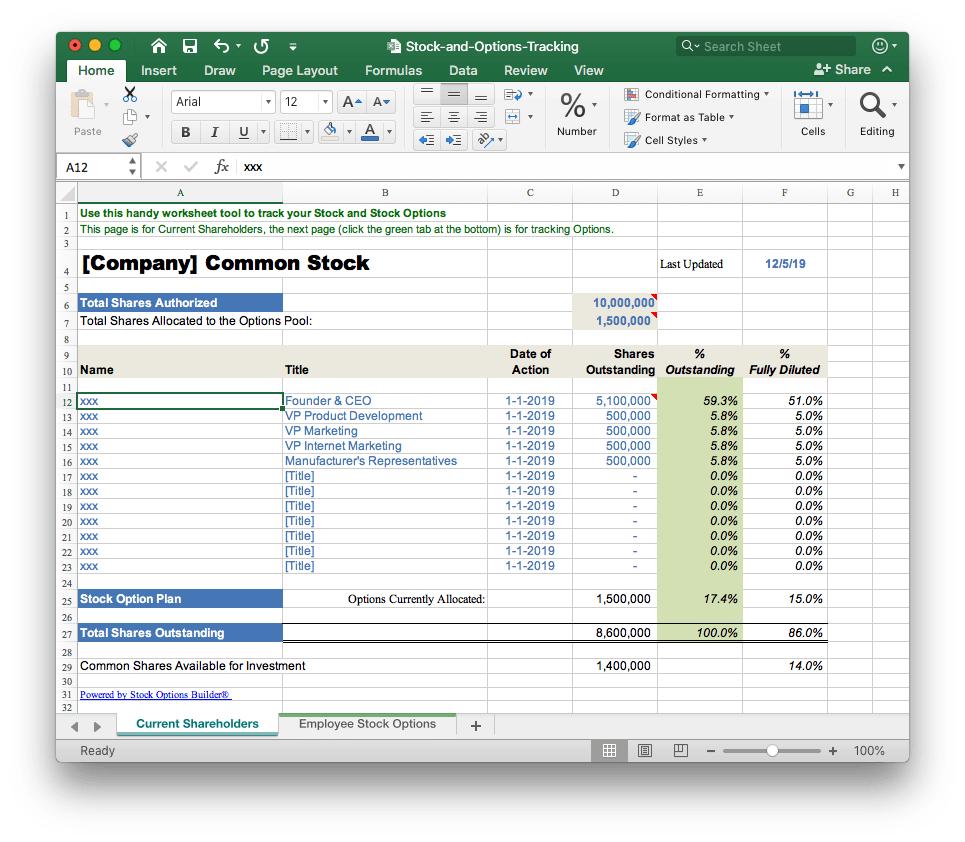

Share planning & tracking worksheet

Use this Excel spreadsheet to list all of your shareholders as well as option holders.

Keep track of when you gave the options, the option price, vesting — the worksheet automatically calculates the balance of shares available for investors, other employees and contributors.

- Track all stock of your shareholders as well as executive and employee stock options with this “checkbook-like” spreadsheet.

- Also keep track of the details of your executive and employee stock options allocations — automatically calculates balances.

- Automatically recalculates ownership percentages.

- We’ve been using this system ourselves for many years as people have come and gone, and it keeps everything clean and simple!

- Like everything we make, it’s made to be customized any way you like.

FYI… Be careful talking in terms of “%” ownership!

Many people seem to get hung up on what percentage of the company they own at any given time.

If you need to sell more shares to raise capital or hire a new person, everyone’s ownership piece of the pie is going to dilute.

It’s crazy-making to be constantly looking over your shoulder and worrying about what your people think is their percentage of ownership in your company.

“I did something so I deserve more of the company!”

Constantly recalculating and discussing your percentage of ownership is a psychological nightmare especially for management trying to maintain people’s desire to work.

You can buy complex software to keep track of these changes as people come and go (or use the simple worksheet here), as well as when investments are made, but be careful talking in terms of % ownership.

It’s OK to talk percentage at the initial stock allocation (including vesting schedule), but since the % of company ownership will change constantly, it’s the wrong thing to focus on.

Going forward, it’s best to speak only in terms of number of shares.

The idea is that each person has their shares and everyone gets rich the same way ⇒ share price!

Otherwise, you spend too much time managing expectations and refereeing who owns how much.

You just don’t need your team distracted from doing what they can to increase the value of their shares.

Your focus immediately after getting options or shares should be simply on the number of shares you have and the value per share.

What you can be doing to increase the value of the company?!?

System manages files, just edit like using Office, but simpler.

You already know how to use it!

Stock Options Builder is easier to use

than Office and works just as you’d expect.

Stock Options Builder manages collections of text and spreadsheet files and enables you to easily edit and combine them into a contiguous document.

- Just click on the template you want to edit

and it opens after inserting your company info.

(Remember mail-merge? Yes, like that.)

- Then scroll through each section and edit.

- You can add-to, edit and customize

any document the way you want.

- Drag and drop sections to change the order.

- Add your own external documents.

- Collaborate over the Internet.

- Prints to PDF as well.

Cut legal costs, start with pre-scripted document templates.

You can do most of this yourself

You can put your complete executive and employee incentive stock options compensation plan in place yourself for a fraction (a very small fraction) of the cost of having it written from scratch.

Then have your attorney (please see a specialist) or our affiliated law firm review it for completeness.

Supported by a law firm specializing

in entrepreneurs and stock options.

Stock and stock options require special counsel.

Stock Options Builder is further supported by the Burk & Reedy Law Firm.

If you have question or need further advice you can call them for

professional legal counsel (fees apply, and they’re worth it).

Go forth and build your company

With a proven stock options plan in place, you’ll motivate your executives

and employees to increase profits, improve efficiency, and enable you to grow.

If you want this in place ASAP…

“More often than not, sound legal documents can be purchased over the internet to cover better than 99% of most company’s needs.

I have found Stock Option Builder to be a good example. As to implementation directions, the plan clearly states

all relevant responsibilities, obligations and processes — it’s all here. 5 of 5 Stars!”

~ Dennis Thomas, Knowledge Foundations, Westminster, CA

Everything to implement a stock-options plan for your company.

Start saving cash while engaging and motivating your people.

- Includes all Stock-Options and supporting documents:

- Cover Letter to Employees

- Stock Option Agreement

- Stock Option Plan

- Summary of Terms of the Stock Option Plan

- Common Stock Purchase Agreement

- Board of Directors’ Approval

- Stock Certificate

- Executive Employment Agreement

- Multi-user document management.

- Supporting comments throughout explain everything and provide direction.

- Easily edit & format.

- Includes handy Excel®-based worksheet / workbook for tracking all stock and options.

- Immediate access after purchase.

- $197 One-Time Investment – Includes access to Stock Options Builder online.